ComparaOnline increases car and travel insurance conversion rates by 18%

18%

increase in conversions

1M+

active users monthly

Automated

Lead re-engagement

ComparaOnline picked Bird because it allowed them to make their sales process more efficient by automating lead qualification, routing new leads and bringing context from conversations to every customer interaction.

Challenge

The team responsible for engaging leads for ComparaOnline’s car and travel insurance products wanted to improve conversion rates and sales. But, as users moved through the sales funnel, they encountered high friction at each step of the buying process. This slowed the sales team down and hindered chances for new leads to convert.

The key challenges came down to:

Lead qualification - Without a system to qualify leads, sales agents were spending valuable time focused on leads who were just window shopping.

Managing various numbers - With their existing process, all leads were manually assigned to sales representatives in batches, further delaying response time. Reps then had to follow up through different WhatsApp numbers owned by the company, making it difficult for other team members to access historic conversations.

Reduce drop-offs -Reactivating leads who dropped off during the sales process was costly and inefficient. The team could not set up automatic reminders to bring leads back where they left off.

Late payments - During the post-purchase stage, the marketing team couldn’t reach customers who were late on their payments. Customers, who had purchased insurance through ComparaOnline, received a call reminding them of their monthly payments, which was costly and slow.

ComparaOnline needed a platform that could help them remove friction by automating messages at each phase of the sales process and moving to a more centralized WhatsApp business solution.

Solution

After evaluating several vendors, ComparaOnline picked Bird because it allowed them to make their sales process more efficient by automating lead qualification, routing new leads and bringing context from conversations to every customer interaction.

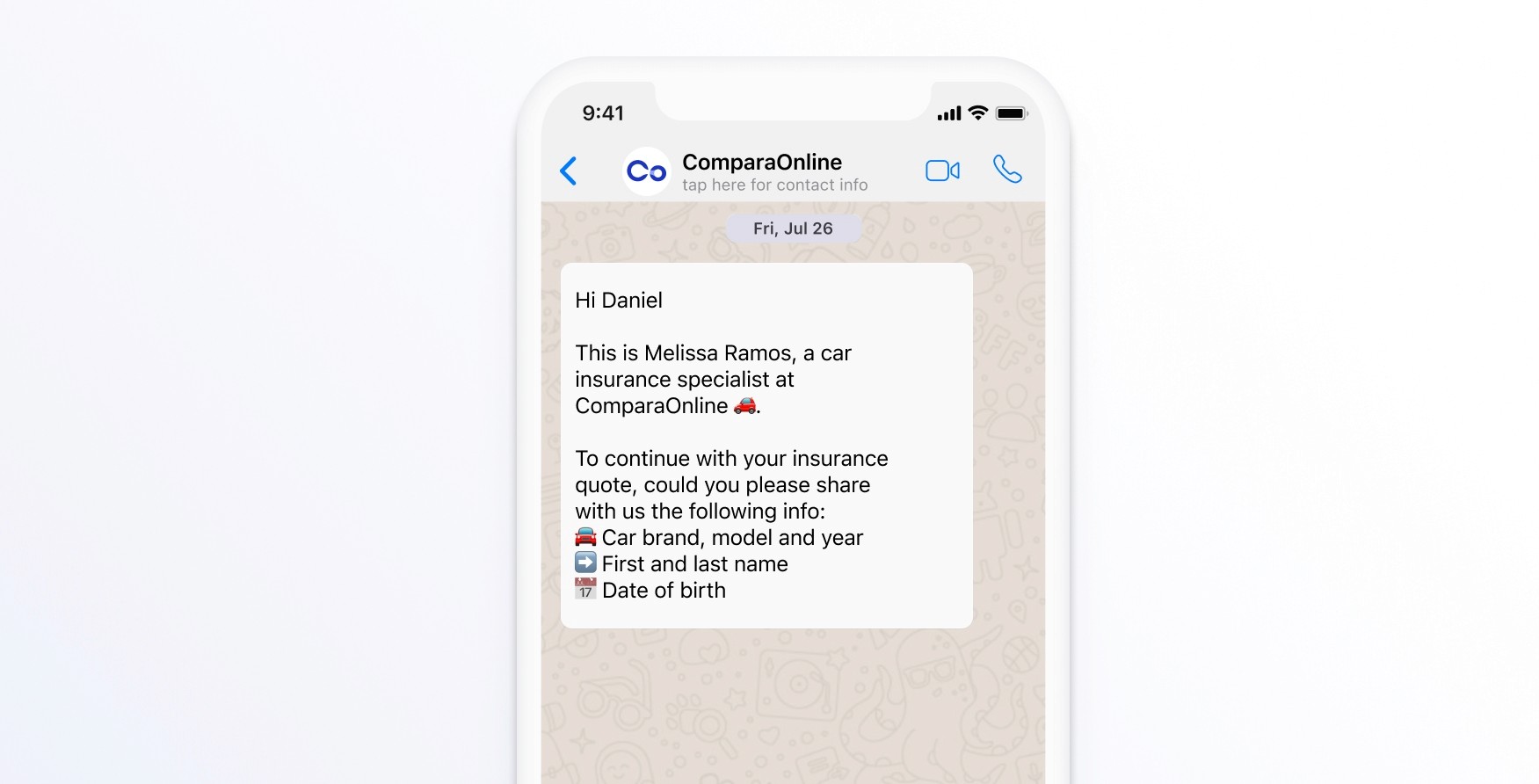

Vetting qualified buyers with automated messages

ComparaOnline built messaging flows to automate and streamline key stages in the buyer’s journey. The company could now qualify leads early on in the process with a simple automated message. Only the leads who responded to that message and showed genuine interest in buying insurance were handed off to the next available sales reps.

Automated re-engagement of unresponsive leads

Dormant leads — who didn’t respond to the first message or call — were easily reactivated with automated reminder notifications sent through WhatsApp or SMS. Also, post-purchase reminders of monthly payments were now triggered automatically when payments were due or delayed.

Creating more personalized and streamlined experiences

By integrating WhatsApp conversations with their CRM, sales reps could easily access customer profiles and read their forms and conversations. This helped them to recommend the right insurance products (based on customer vehicles or requirements) and find out how urgently potential customers required coverage. All of this led to more personalized experiences that resulted in higher conversions.

Results

With the help of WhatsApp Business and Flow Builder, ComparaOnline was able to improve the sales process for its car and travel insurance. The company reported an impressive 18% increase in conversion rates for these insurance products.

Their sales reps now spend less time on manual tasks and chasing unqualified leads, which ultimately contributes to higher conversions. What’s more, they can engage with customers across all of the LATAM countries they operate in through a single platform.

“With Bird, we’ve reduced friction in our buying experience by automating reminders and manual steps in our sales process,” said Andrea Trujillo Godoy, Product Manager at ComparaOnline.

"With Bird, we’ve reduced friction in our buying experience by automating reminders and manual steps in our sales process."

Andrea Trujillo Godoy, Product Manager